Key takeaways

- Travel hacking can help you score free or discounted flights, hotel stays and more by strategically using credit card rewards.

- To get started, set a travel goal for yourself and investigate various rewards programs for the lowest redemptions, then use your research to choose a travel credit card based on factors like your credit score and the annual fee cost.

- Using shopping portals and dining rewards programs is another way to score extra points, along with taking advantage of card-linked offers from programs like Amex Offers and Chase Offers.

- Stay on top of “mistake fares” by signing up for notifications from airfare deal sites, and consider booking travel during award sales or off-peak travel seasons.

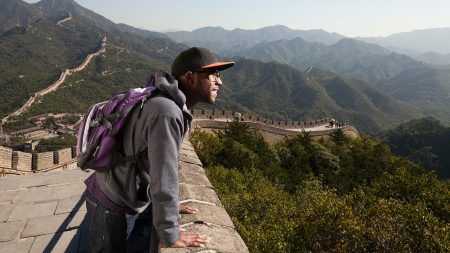

Over the last decade, travel hacking has gone mainstream, thanks to social media. With influencers showing off luxury vacations booked with points, everyone wants in on the action.

And the appeal is widespread. Families can significantly bring down the cost of a Disney vacation, for example, while the aspirational crowd can book first-class tickets for pennies on the dollar.

As someone who has been travel hacking for over a decade, I’ve seen and done it all. It’s a rewarding hobby that can open up a world of travel opportunities. By hacking flights and hotels, you can save substantially on these expenses.

What is travel hacking?

Travel hacking typically refers to the various ways you can earn points and miles toward future travel, often without flying or staying at hotels. It involves strategically using credit card points or miles, or those earned with airline and hotel programs, to score discounted travel perks.

How to start travel hacking

Getting started with travel hacking can seem overwhelming, but we’re here to break it down for you. Here are some tips to help you get started:

1. Set a goal

The first step in your travel hacking journey is to set a travel goal. Earning points without knowing what you’re working toward can be an exercise in futility. When I started back in 2011, I made the mistake of accruing Delta SkyMiles and American AAdvantage miles for a trip to Europe. I learned pretty late that American Airlines had a weak route network to Europe at the time, and that United MileagePlus miles would have been a much better option.

Think about where you want to go well before you start focusing on how you’re earning points. Then, research the best rewards programs to get you there. Bankrate’s travel toolkit highlights a variety of credit card, airline and hotel rewards programs to help you make the best choice.

2. Find the right rewards credit card

The easiest way to boost your points balance is with a rewards credit card. After you sign up and get approved, you can typically earn a welcome bonus of 50,000 or more points after completing a spending requirement over three or more months.

While welcome bonuses are a significant draw, you can also take advantage of category bonuses and annual spending bonuses to maximize your everyday spending more rewarding long-term.

Those ongoing rewards should be an important factor in your travel rewards card decision. Most people will benefit from credit cards that earn transferable rewards like these:

These currencies offer flexibility because you can transfer them to several airlines or hotel programs at a 1:1 ratio, or close to it. If one airline doesn’t have award space on your desired travel dates, then you can transfer them to one that does. You’ll have options and stay protected against possible program devaluations as well.

3. Check the requirements before applying

Once you have a general sense of which credit card to apply for, make sure you qualify and prepare to meet any application requirements. Here are a few things to consider:

- Your credit score. As you might expect, the best travel rewards cards require at least good credit, but many favor those with excellent credit. If you’re still working on your credit, consider waiting to apply for when you have a better chance of approval.

- The application rules. Every bank has its own rules pertaining to credit card approvals. Chase has the infamous 5/24 rule that restricts welcome bonuses if you’ve applied for five or more credit cards in the last 24 months. Amex’s once-per-lifetime restriction means if you’ve earned a welcome bonus for one card, you likely won’t be able to earn the same bonus again. There are many more credit card application rules to be aware of. Knowing them before you apply improves your chances of approval.

- How much you’ll pay. If you struggle with paying your credit cards off every month, travel hacking with credit cards is probably not for you. That’s because the interest rates on these credit cards are generally high and will negate any rewards you earn. If you’re not confident you can pay off your balances, you’re better off skipping these credit cards and using alternate methods to earn points and miles.

4. Use shopping portals

Shopping portals are the way to go if you want to further maximize your points and miles earnings. Nearly every major loyalty program has a shopping portal you can earn rewards with, whether it’s your card issuer or your airline of choice. You’ll earn at least one extra point per dollar spent, plus the points from your credit card.

Here are a few examples:

You can easily ensure you’re earning the most points possible with a shopping portal aggregator like Cashback Monitor. Type the name of an online merchant, and you’ll get a list of shopping portals alongside their earn rates.

Many shopping portals also offer spend-based bonuses around the holidays and right before the school year starts. These can be pretty lucrative and help you reach your travel goals faster.

5. Sign up for dining rewards

Dining reward programs are similar to shopping portals in that they require minimal effort to earn extra points. You can join airline and hotel-affiliated dining programs to earn up to 8 additional points per dollar spent, including:

Some of these programs offer first-dine bonuses and extra points when you write reviews or meet certain spending thresholds every year.

You can join all of these programs, but since they’re all part of the same network, you can’t register the same credit card with more than one program at a time. That shouldn’t be too challenging, even if you only have one credit card.

Simply register your card with the program of your choice, earn the first-dine bonus and repeat with the other programs until you’ve earned them all. Don’t forget to use a credit card that earns bonus points on dining to maximize your earnings.

6. Get creative with earning rewards

Once you’ve gotten into the habit of maximizing your everyday purchases, it’s time to get creative. What else can you charge to your credit card while still maintaining a balance that you know you can pay off at the end of the month?

I once convinced my boss to let me pay a $35,000 supplier invoice with my credit card. I’ve earned thousands of points on rent and mortgage payments through Plastiq. I’ve also used retail arbitrage to flip popular fashion items and earn spending requirements.

Think outside the box and you could be well on your way to discovering new ways to boost your points.

What are the best travel hacks?

There are countless travel hacks out there, and the best ones are top secret (for good reason). But if you’re just getting started and want to keep things simple, here are the most valuable hacks to know:

-

Credit card sign-up bonuses, also called welcome bonuses, are by far the best way to earn a lot of points within a short time frame. You may even piece together a luxury vacation by strategically applying for credit cards.

Just make sure you’re aware of those issuer rules that limit how many credit cards you can apply for. Plus, you’ll have to meet the spending requirements on all of those cards separately in order to get the welcome bonuses, which could be hard if you have to spend several thousand dollars on your cards each month.

You should also be careful when applying to more than one card in a short time frame. Not only will you need to spend even greater amounts to get more than one bonus, but you can hurt your credit score and make yourself look risky to potential lenders.

-

Double- or triple-dipping is one of the best travel hacks out there. Stacking travel hacking methods can help you earn significantly more miles. For example, let’s say you’re in the middle of a home renovation project — you’ve got expenses, and they’re big. If you can do some shopping online for your project, you can double-dip by earning rewards on your credit card and through an online shopping portal.

If you happen to have an Amex card, you could triple dip by taking advantage of Amex Offers. I’ve managed to do this for large expenses like travel bookings and furniture purchases. Before you buy, think about all the possible ways to earn points and find opportunities to combine them.

-

There’s more to travel hacking than just earning and redeeming points. One of my favorite ways to hack travel is through mistake fares. Sometimes airlines mess up and publish fares well below market value. I’m talking about a $450 round-trip business class ticket to Shanghai or a $120 economy class ticket to Abu Dhabi. Over the years, there have been dozens of great mistake fares that travel hackers have taken advantage of.

In most cases, airlines have honored these mistake fares, which has been great for savvy travel hackers who managed to book them. Just know that you may need very flexible travel plans and dates to take advantage.

A great way to stay on top of mistake fares is to sign up for alerts with Airfarewatchdog and The Flight Deal. These sites parse the web for amazing deals and share them on social media and their websites when they come around.

-

When you’re ready to book that dream vacation you’ve been saving for, there are three types of awards you should look into:

- Sweet spots: “Sweet spots” are award flights or hotels that are priced lower than competitors. For example, a round-trip business class ticket to Europe normally costs 160,000 miles or more with programs like United MileagePlus. But if you redeem points through fellow Star Alliance program ANA Mileage Club, you’ll need just 96,000 miles round-trip.

- Off-peak award charts: Most airlines and hotel loyalty programs discount awards during off-peak season. For example, American Airlines offers discounts on award flights to Europe if you travel between January 10 – March 14 or November 1-14. With most airline and hotel loyalty programs using dynamic pricing, you’ll generally get better deals by redeeming miles during off-peak or shoulder season.

- Award sales: Sometimes airlines run award sales on certain routes, which can lead to significant savings. For example, Air France and KLM’s joint Flying Blue program offers up to 50% off through their Promo Rewards sales. Meanwhile, Hilton Honors and Marriott Bonvoy offer the fifth night free when you book four consecutive stays using points and meet other requirements, saving you 20 percent on five-night stays. Many airlines and hotel chains offer peak and off-peak award pricing. By being flexible with your travel dates, you can stretch your hard-earned points further.

How can I travel for free?

Despite what travel influencers like to put into their photo captions, there’s no such thing as free travel. You almost always pay a fee to earn or redeem points. Whether it’s your credit card annual fee, award flight taxes or resort fees, there will always be costs.

But by leveraging credit cards, points and loyalty programs, you can book incredible travel experiences at a fraction of the cost.

The bottom line

Travel hacking can allow you to travel further and in bigger ways than booking with cash. From hotel, airline and transferable points currencies, you can travel for relatively little cost by using credit cards to pay for your everyday expenses.

If you’re thinking about opening a travel rewards credit card, keep in mind your travel goals, the card’s sign-up bonus and benefits and how you plan to redeem the rewards you earn. From there, you can try more advanced methods of earning points such as through shopping portals or dining programs.

In addition to all of these tips, don’t forget the responsibility that comes with credit card usage. Even the best travel credit cards can have high interest rates, so be sure to pay your card off in full each month as often as you can to avoid canceling out any rewards you might earn.

Read the full article here