Meet the faces behind the U.S. central bank.

The Federal Reserve is tasked with maintaining a stable and sound financial system — most notably by raising or lowering interest rates at (what’s typically) eight meetings a year. A group of policymakers within the Fed vote on those interest rate decisions: the Federal Open Market Committee (FOMC), all of which directly influence the economy and your wallet.

The Fed’s interest rate decisions impact how much you may pay to borrow money and how much interest you earn when you save.

Decisions on monetary policy are made by committee. While the Fed chair is the recognizable face of the Federal Open Market Committee, they do not single-handedly make the decisions affecting the economy but try to reach a consensus among the committee.

— Greg McBride, CFA | Bankrate chief financial analyst

Here’s what the FOMC is, who’s on it and why this group matters for your finances.

What is the FOMC?

The FOMC is the group of Fed officials given the sole authority of voting on whether to raise, lower or maintain interest rates. The FOMC, specifically, is one of three branches within the Federal Reserve System (the FOMC, the board of governors and the 12 regional reserve banks).

Who is on the FOMC?

The FOMC is made up of 12 members: the seven board of governors, the president of the regional New York Fed and four other Reserve Bank presidents located throughout the country. The board and the New York Fed president have permanent voting positions, while the four regional bank presidents rotate on and off the board annually.

The Fed’s board of governors

The permanent members of the Fed’s board of governors are:

- Jerome Powell, chair

- Michael Barr, vice chair for supervision

- Michelle Bowman, governor

- Lisa Cook, governor

- Philip Jefferson, governor

- Adriana Kugler, governor

- Christopher Waller, governor

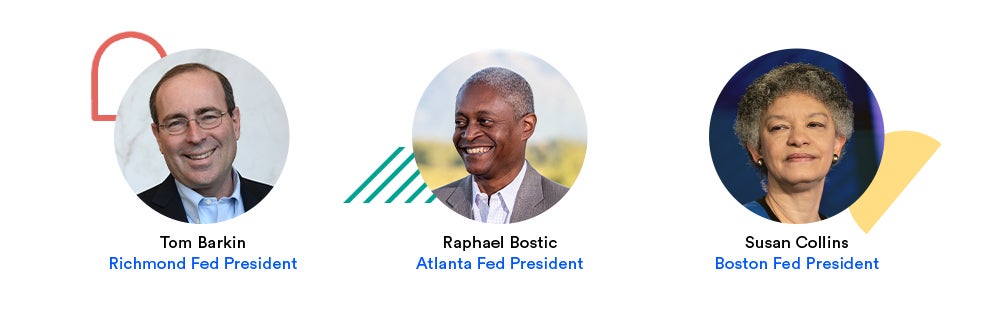

The regional Fed bank presidents

Meanwhile, the five other slots on the FOMC come from the 12 regional Fed banks.

| Official | Regional Fed bank | Voting year |

|---|---|---|

| Source: Federal Reserve Board of Governors | ||

| Tom Barkin | Richmond | 2024 |

| Raphael Bostic | Atlanta | 2024 |

| Susan Collins | Boston | 2025 |

| Mary Daly | San Francisco | 2024 |

| Austan Goolsbee | Chicago | 2023 |

| Patrick Harker | Philadelphia | 2023 |

| Neel Kashkari | Minneapolis | 2023 |

| Alberto Musalem | St. Louis | 2025 |

| Beth Hammack | Cleveland | 2024 |

| Lorie Logan | Dallas | 2023 |

| Jeffrey Schmid | Kansas City | 2025 |

| John Williams | New York Fed | Permanent voting member |

Goldman Sachs alumna Beth Hammack will officially assume the role of Cleveland Fed President on Aug. 21. Until then, the regional Fed bank’s First Vice President Mark Meder will be serving as interim president.

Even those who don’t have a vote still have some influence. All 12 regional reserve bank presidents attend meetings, participate in policy discussions and contribute to the assessment of the economy just as much as other voting members in attendance, informing everyone on how well their regions are performing. Their projections are also included in the Fed’s quarterly projections.

The chair of the board serves as the chair of the broader FOMC, a position currently served by Jerome Powell, whose second four-year term began in May 2022. Other former chairs include Janet Yellen, Ben Bernanke and Alan Greenspan.

What does the FOMC do?

Most notably, the FOMC sets a key benchmark interest rate — the federal funds rate — that influences other borrowing costs throughout the financial system, such as credit cards and home equity lines of credit (HELOC) rates, as well as yields on savings accounts and certificates of deposit (CDs).

Fed officials consider a dual mandate — stable prices and maximum employment — when deciding to raise, lower or maintain interest rates. The FOMC also participates in what’s called “economic go-rounds” during meetings, where each official shares what’s happening in their individual regions.

After each Fed meeting, the FOMC issues a policy statement that explains what officials decided to do and why. Three weeks after each meeting, records of that meeting known as minutes are published. Complete transcripts featuring word-for-word dialogue that took place during FOMC meetings are published five years later.

Under Fed Chair Jerome Powell’s tenure, the FOMC also moved toward holding a press conference after each meeting, hosted by Powell. Previously, it held them every quarter.

Every other meeting, Fed officials submit individual economic forecasts for employment, gross domestic product (GDP) and inflation. They’ll also mark down their projections for where interest rates are likely to go in the years ahead, in a chart known as the dot plot. Both of those reports make up the “Summary of Economic Projections.”

But the FOMC decides on more than just adjusting interest rates. It also conducts open market operations, where it buys and sells securities. That process, formally called large-scale asset purchases but more colloquially known as quantitative easing, can influence longer-term interest rates, while also expanding or contracting the money supply.

When does the FOMC meet?

The FOMC typically meets about every six weeks, culminating in about eight meetings a year. Broader economic events could, however, prompt the Fed to meet outside of its original schedule.

That was the case during the financial crisis of 2008, as well as the coronavirus crisis in March 2020. Officials voted to reduce interest rates at two emergency meetings within 13 days of each other, bringing borrowing costs down to near-zero percent for the first time since the financial crisis.

Who decides who is on the FOMC?

The Federal Reserve System is designed to be independent of government, though not independent from government. The Fed’s board ultimately reports to Congress. Members are appointed by the president, approved by the Senate Banking Committee and then the broader Senate before coming to the Fed.

The regional reserve bank presidents, on the other hand, have more separation from Congress. A board of directors at each reserve bank, made up of local business contacts, leaders and experts, decides who ultimately serves at the helm. They’re then approved by the Fed’s board of governors.

Interest rate decisions: The influence of doves, hawks and centrists

The Fed has to reach a majority consensus for most of its decisions, but every expert may interpret economic data differently. Thus, many Fed watchers focus on the ideologies and priorities of each individual member — often colloquially categorizing them as either “doves” or “hawks.”

Fed officials and their economic bias

- Doves: Tend to be more concerned with the labor market, which might lead them to prioritize keeping interest rates lower for longer.

- Hawks: Focused on preventing inflation or asset bubbles, which might lead them to prefer higher borrowing costs.

If a voting board tends to be made up of more dovish members, it might indicate a lower interest rate policy in the year ahead. If that same voting body is more primarily composed of hawks, they might be more willing to raise interest rates at a faster pace.

Ultimately, however, the Fed describes itself as “data dependent,” deciding what to do with interest rates based on employment, inflation and growth data. It was hard for even doves to deny the need to raise interest rates as inflation pushed to the highest level since the 1980s. Since the Fed began raising interest rates to combat inflation in March 2022, just two officials have dissented — but only about the size of those increases, not the validity of raising them at all.

Those differing ideologies, however, could matter even more than usual as the Fed juggles what to do next with interest rates. An official who takes a hard stance on inflation may be more inclined to keep borrowing costs higher for longer, while a policymaker focused on protecting the job market might be more inclined to let up on the brakes.

Bottom line

The FOMC’s decisions arguably impact your wallet more directly — and more quickly — than any other policymaker in Washington. What it decides to do can steer the broader economy away from recessions, while also influencing how much you pay to borrow and what you’re paid to save.

Read the full article here