Franek Strzeszewski/Getty Images

Key takeaways

- Capital One offers referral bonuses for cardholders who get their friends and family to apply for their own cards.

- While there is no limit to how many referrals you can make, there is a limit to how much you can earn from referrals per year depending on your card (typically up to $500 for personal consumer cards).

- You’ll only receive the bonus if your referral is approved using your unique referral link.

You can earn up to $500 a year and potentially more with the Capital One Refer a Friend program. Exactly how much you can earn in points or cash back comes down to the card you have, how many people you’re able to successfully refer each year and the limits that apply to various cards.

Earning a referral bonus may also be easier than you think. All you have to do is send someone a referral for a Capital One credit card, and if they’re approved, you’ll be eligible to earn a bonus. Keep reading to find out how to do it.

What is Capital One Refer a Friend?

Capital One Refer a Friend is the card issuer’s referral program for its credit cards. This program rewards current cardholders in good standing for telling friends and family (and even total strangers, if you feel like it) about Capital One.

However, you’ll only receive the bonus if:

- Your referral is not the primary cardholder of any Capital One cards

- Your referral uses the unique referral link sent by you

- Your referral is approved for the card

Just remember that referral bonuses only apply if the other person is approved for the card based on their income, credit score and other factors. If they’re denied the card for any reason, you won’t receive a Capital One referral bonus of any kind.

How does the Capital One Card referral program work?

To refer someone you know, you’ll send them a unique link they can use to sign up for the card. It will redirect them to the card’s application, which they can fill out with information like their full name, address, household income and Social Security number.

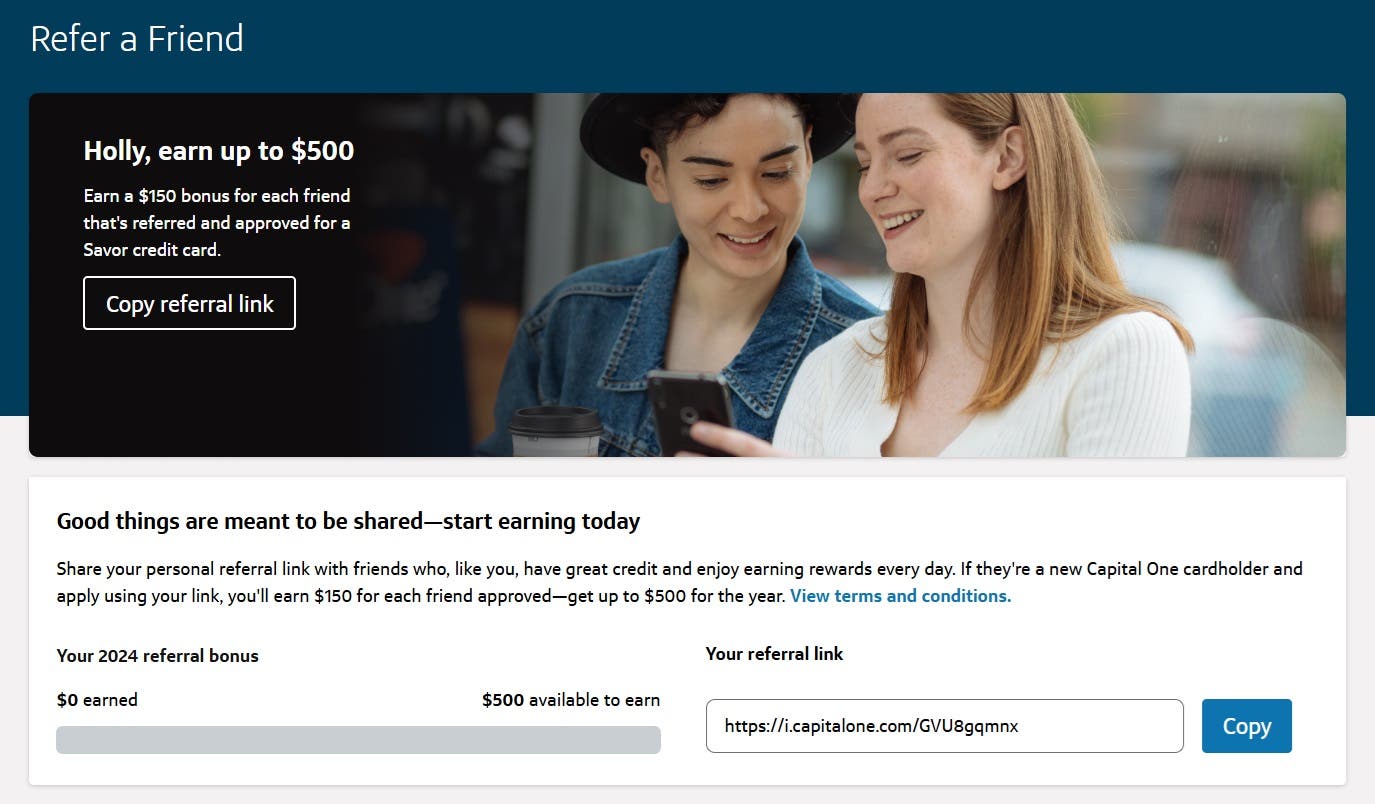

EXPAND

Just remember that not all Capital One cards participate in the referral program, and you can only refer a card that you currently hold in good standing.

Steps to refer friends to Capital One

If you prefer to go the easy route, you can head to the Capital One Refer a Friend page and log in to refer friends from there. You can also refer friends by logging into your Capital One account online or through the mobile app first and taking the following steps:

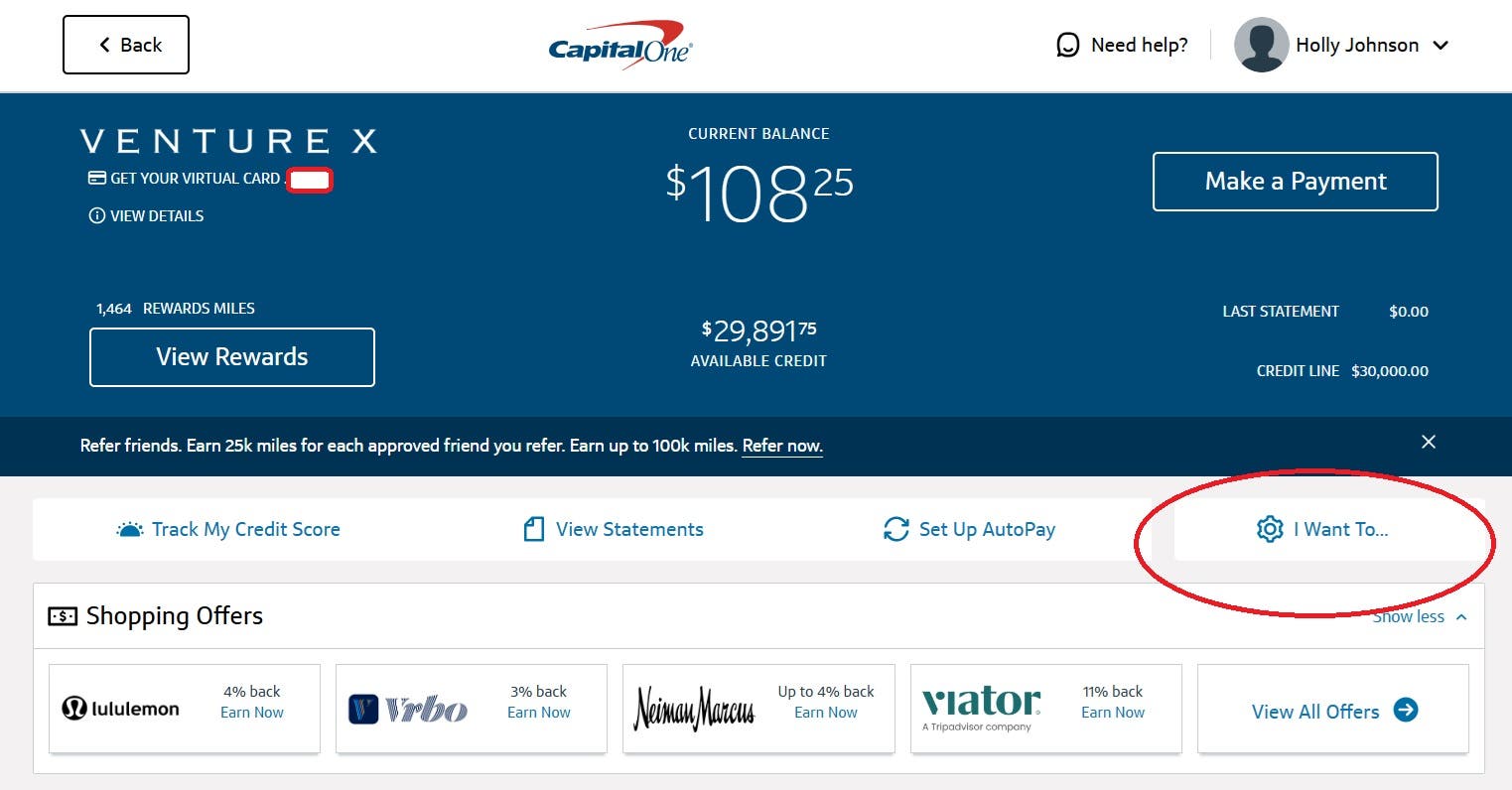

Step 1: Sign in to your Capital One account and select the option that says, “I Want To.”

EXPAND

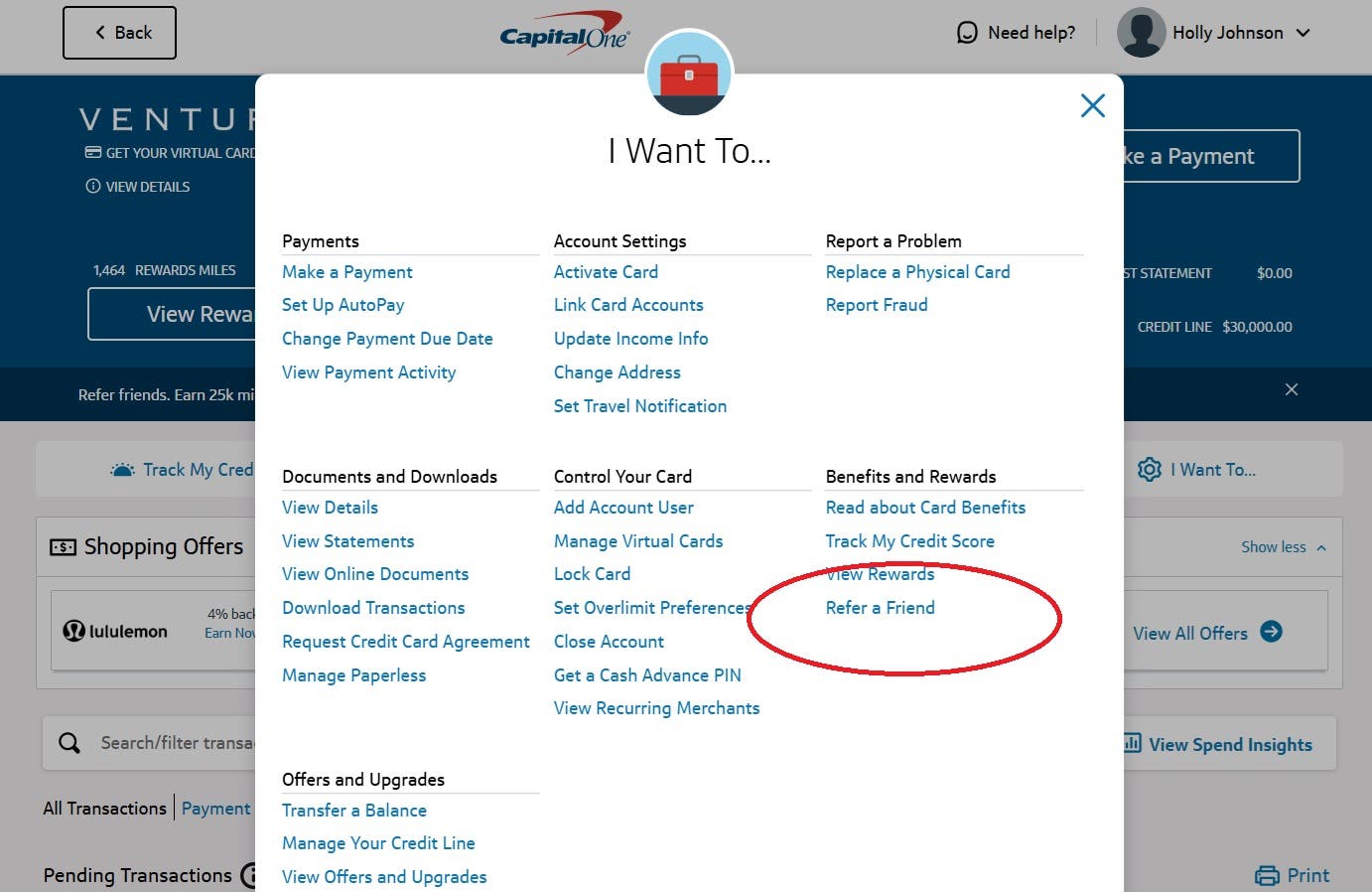

Step 2: Browse through the options available to you and select “Refer and Friend” from the list.

EXPAND

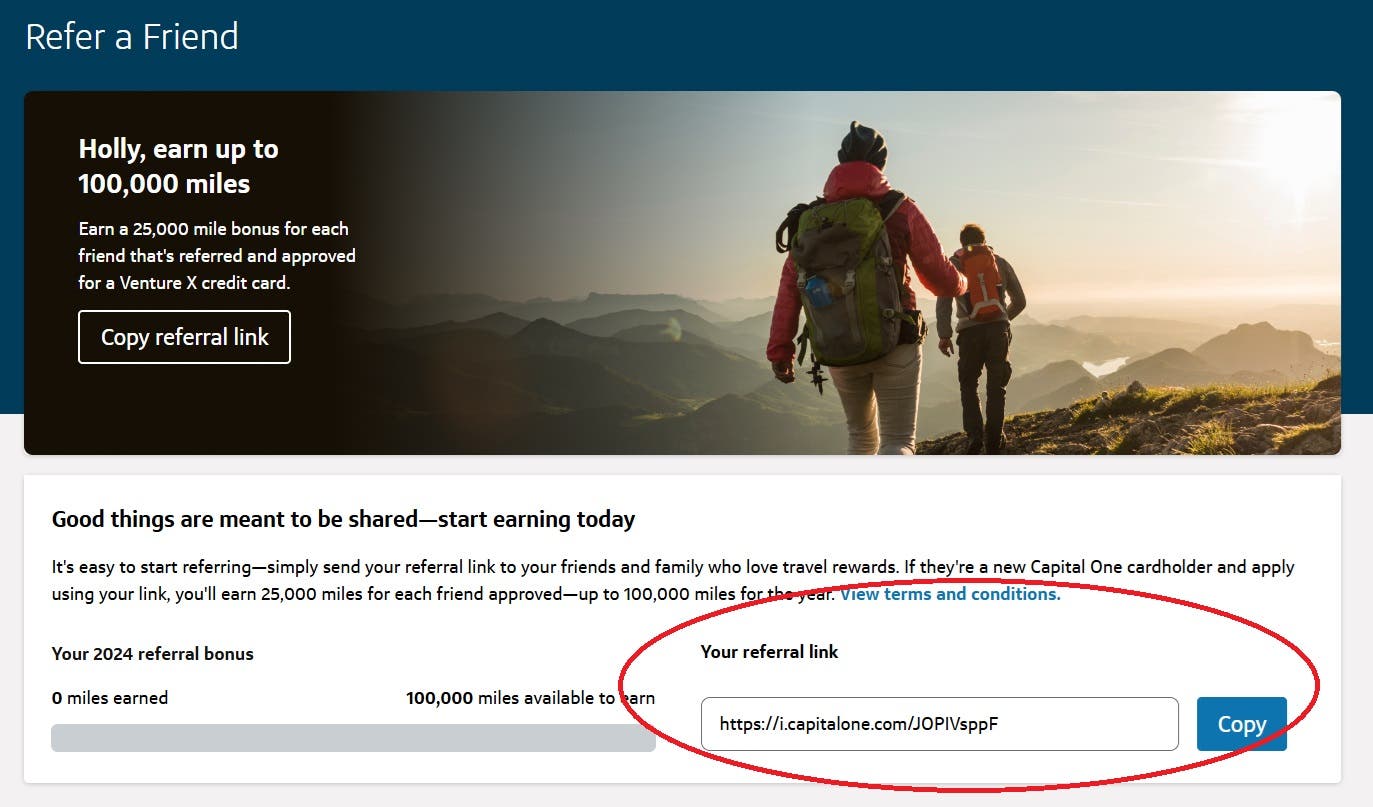

Step 3: Find your Capital One referral bonus link and send it to your friends.

EXPAND

If they apply and are approved (and all other requirements are met), you’ll earn your specified referral bonus. However, if they don’t use your referral link to apply, you won’t earn a reward — even if you were the one who told them about the card.

How much is the Capital One referral bonus?

Capital One referral bonus amounts vary by card, and annual referral bonus caps also apply. For example, you may be eligible to earn 25,000 miles for each friend you refer to the Capital One Venture X Rewards Credit Card, up to 100,000 miles per year. Based on recent point valuations from Bankrate, this means you could earn referral bonuses worth $1,700 annually if you successfully refer four other people to this card each year.

Some referral bonuses aren’t quite as generous because, as mentioned, offers vary by card. For example, you can earn a referral bonus up to $150 for each friend you refer to the Capital One Savor Cash Rewards Credit Card (up to a maximum of $500).

EXPAND

When do I receive the bonus?

According to Capital One, it can take some time (up to eight weeks) for the rewards from a referral bonus to hit your account.

Also be aware that bonuses you earn count toward the maximum in the year you earn them — not the year you refer. If you refer a friend to a Capital One credit card in December of 2024 and they don’t sign up and get approved until January of 2025, for example, your referral bonus would count toward the 2025 bonus threshold.

Who is eligible for Capital One Refer a Friend?

You have to have a Capital One credit card in good standing in order to participate in the Refer a Friend program. So, if your account is in default, you won’t have the option to share a referral link. Also, note that only certain Capital One cards are eligible:

Accepting a Capital One referral: Caveats and considerations

If you plan to sign up for a Capital One credit card through a friend’s referral link, there are several fine print details to keep in mind. The first one is that the bonus you’re eligible for if you apply through a referral may be different from the public offer that’s available if you sign up for the same card elsewhere. Make sure you aren’t short-changing your bonus potential by applying through a referral.

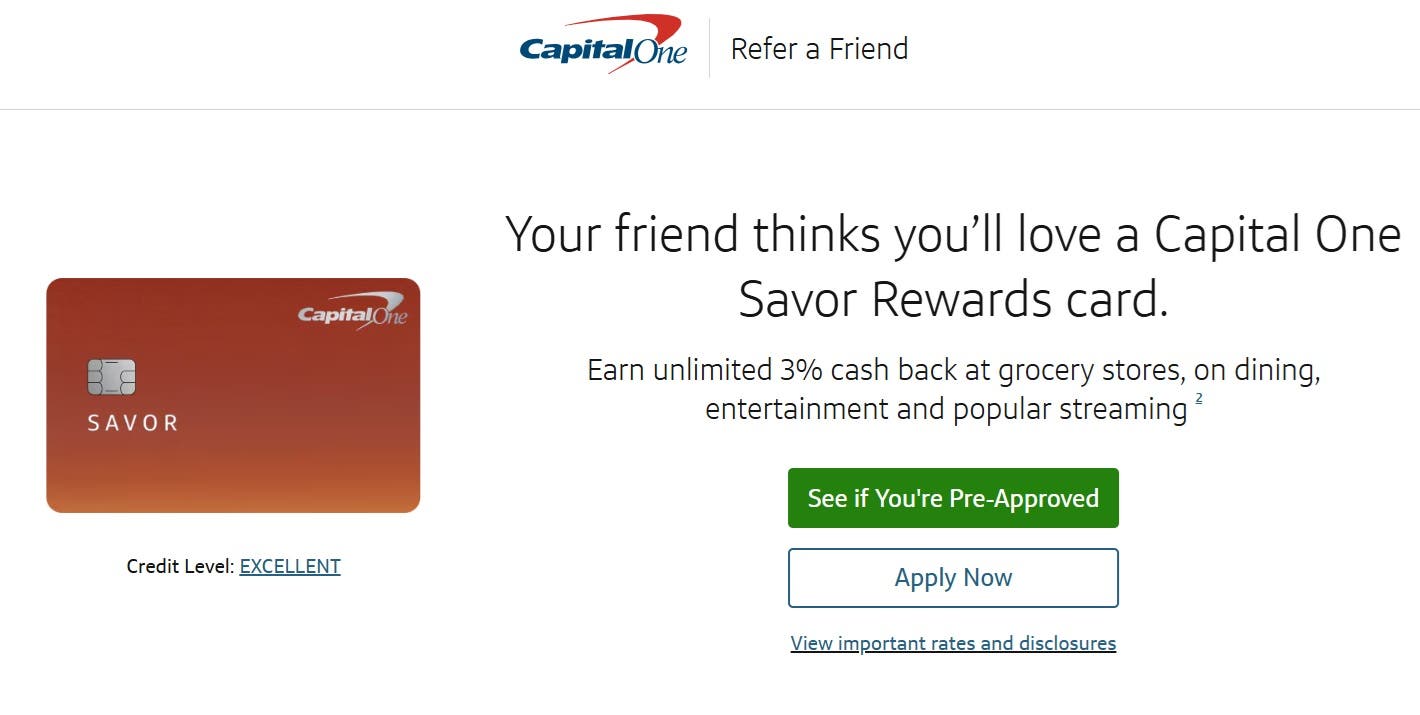

Also, make sure the referrals you receive are for the card you actually want. For example, a referral from someone with the Capital One Savor Rewards card will only let you apply for this exact card — even if a different Capital One credit card has caught your eye.

EXPAND

While this cash back credit card is an excellent card for groceries, entertainment and other spending categories, it may not be the best option if you want a top travel card to earn flexible miles for travel instead.

So make sure you’re getting the biggest and best bonus you can — and that you’re signing up for a Capital One credit card you actually want.

The bottom line

Capital One Refer a Friend is a great way to maximize your credit card rewards while sharing card benefits with friends. Once you share your Capital One referral link with someone who is not currently a Capital One cardholder, they’ll need to use the link to sign up for a card that you already own in order for you to receive the referral bonus. Keep in mind that you’ll have to make sure your specific credit card is eligible for the program before you can participate.

Frequently asked questions about Capital One Refer a Friend

All information about the Capital One Spark Classic for Business has been collected independently by Bankrate and has not been reviewed or approved by the issuer.

Why we ask for feedback

Your feedback helps us improve our content and services. It takes less than a minute to

complete.

Your responses are anonymous and will only be used for improving our website.

Help us improve our content

Read the full article here