Key takeaways

- You can earn airline miles by spending on an airline credit card or travel credit card, so you shouldn’t typically need to purchase them.

- However, you might want to consider buying miles if you get a better deal than paying for a flight in cash, or if you’re short a few thousand miles for an award you want.

- Only pay for airline miles if you have a concrete plan to use them right away.

When it comes to earning airline points and miles, there are an endless number of ways to start. You can earn airline rewards by using an airline credit card or a flexible travel credit card for all of your spending, by shopping through airline rewards portals or by joining an airline’s dining club. You may also be able to earn airline miles with other qualifying activities, such as booking hotels and car rentals with a preferred partner of your favorite airline program.

You can also buy airline points or miles outright if you want to rack up a stash quickly, or if you just need to top off your account. But just because you can buy airline rewards, doesn’t mean you should. There are only a few situations where buying airline rewards makes any sense at all, meaning you’ll be better off earning rewards in other ways the vast majority of the time.

Is buying miles worth it?

Buying miles can be worth it, but only if you’re getting more value in return than the cost of the miles you paid. If you’re paying an average of 3 cents per mile to purchase airline miles and you only redeem them for 2 cents per mile in value, for example, buying miles won’t make any sense.

That said, there are some instances where buying small amounts of miles at a premium can help you book the travel you want. If you’re short the miles you need for a truly outsized rewards redemption, for example, buying a few thousand airline miles at a suboptimal price isn’t the end of the world.

But, you should never buy airline miles just because — especially since there are so many ways to earn them for free. For the most part, you should only buy points or miles if you’re in one of the situations we outline below.

When you should buy airline points or miles

So, when does it make sense to purchase airline points or miles? Here’s a rundown of the main situations where you might want to consider it, as well as the steps you should take to find out if it makes sense in your situation.

1. When you can use miles for a flight with a high cash price right away

You may want to consider buying miles if you’re planning to book a pricey fare with cash and the cost of purchased miles works out to less than you would pay. This scenario usually makes the most sense when you’re about to buy an expensive international fare in a premium cabin. However, you’ll need to make sure to buy the miles and lock in the award before it disappears, as they often do since award availability can change by the day (and even by the hour).

For example, you may be able to buy Air France (Flying Blue) miles for a cost of 2.34 cents per mile. While that definitely seems like a lot, it could pay off when you need to book a pricey flight.

Maybe you need to fly from Chicago, Illinois to Dubai, United Arab Emirates this fall and you desperately want to fly in Business class with a lie-flat seat. In that case, it may be possible to find business class fares for as low as 120,000 miles plus $371.10 in airline taxes and fees.

EXPAND

In the meantime, the cash price for this one-way flight with Air France works out to $4,357.

EXPAND

So, how do you know this is a good deal? In this scenario, you would subtract the $371.10 in airline taxes and fees from the cash price to get $3,985.90. At that point, you would divide the remaining cash amount by 120,000 miles to get a per-mile price.

When you do, you’ll find that this per-mile price works out to 3.33 cents each ($3,985.90 / 120,000 miles = 0.033). Since you could buy miles for 2.34 cents each, you would get a better value with this strategy than you would if you paid for the flight with cash instead.

Keep in mind:

Paying with miles can be detrimental to your plans if you’re actively pursuing elite status with an airline. If you want to earn elite status, you may be better off paying with cash instead so the flight cost counts toward elite status requirements.

2. When you’re short a few thousand miles for an award you want

Another scenario where it might make sense to buy miles is when you’re only a few thousand miles short for a reward redemption you want to make. In this situation, you can still get a good deal on purchased miles whether they’re expensive or not. After all, not buying miles could mean missing out on the award flight you want altogether.

Most frequent flyer programs that let you buy miles offer them in fairly small increments so you can easily top off your account. For example, American AAdvantage, Air France / KLM Flying Blue and Delta SkyMiles all let you buy as little as 2,000 miles at a time.

3. The airline is offering a bonus for purchased miles

From time to time, many frequent flyer programs offer a “bonus” for purchasing miles, which typically translates to a discount off its regular rates. Buying during one of these promotional periods is obviously better than buying when a bonus isn’t offered, but that doesn’t mean you should buy miles just for the fun of it.

Unless you have a specific redemption you want to make, you should really only buy miles if you have a goal for them. In any other scenario, you should only buy miles if they’re offered at a price that’s less than what they’re normally worth.

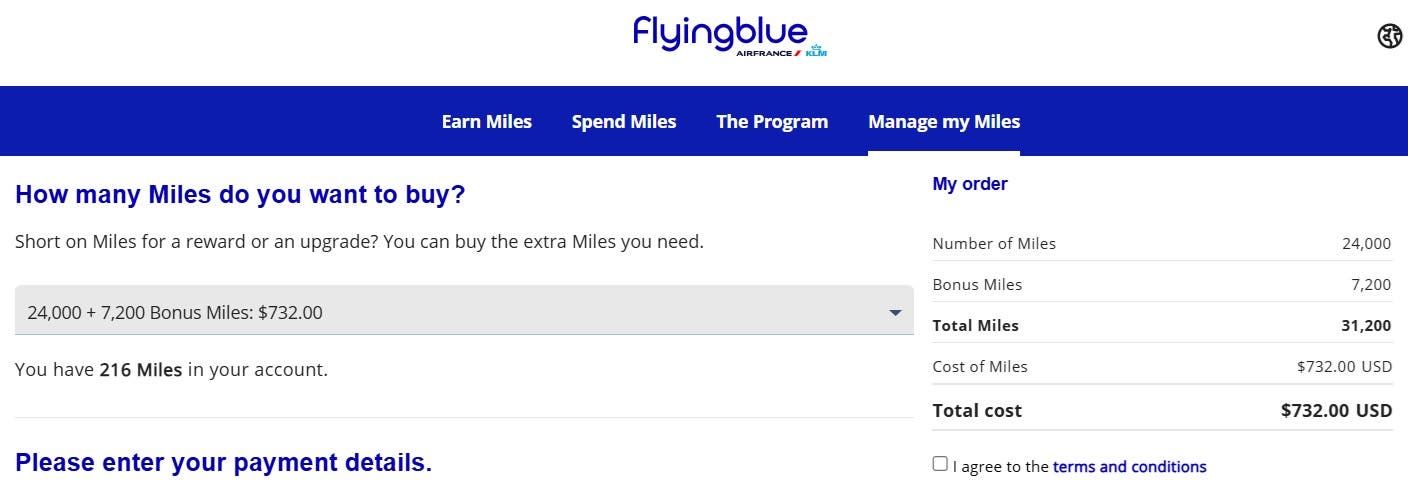

At the time of writing, the Air France (Flying Blue) program is offering up to a 30 percent bonus on purchased miles. However, smaller amounts of miles get a bonus that’s lower. As an example, buying 24,000 miles would actually get you 31,200 miles for a cost of $732.

EXPAND

If you need to make an Air France booking anyway and you’re short on miles, the fact a discount is being offered makes this option a pretty good deal.

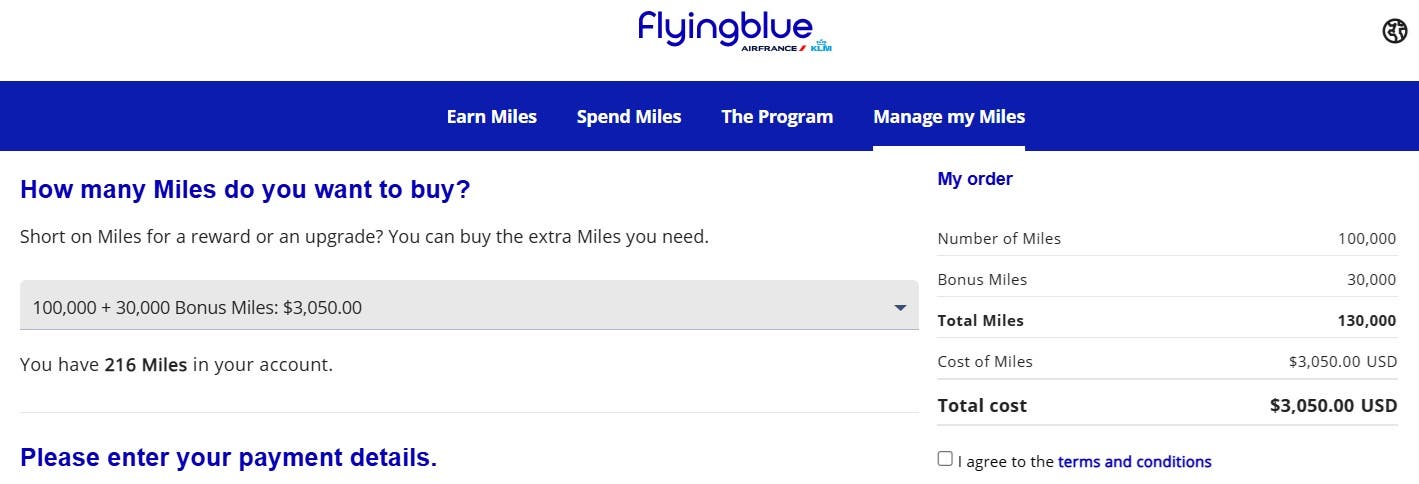

Then again, the value just isn’t there to make the purchase unless you have a concrete reason. For example, Bankrate’s points and miles valuations show that Flying Blue miles are typically worth 1.5 cents each on average, yet the program is asking members to pay $3,050 for 130,000 miles with the 30 percent bonus factored in. This translates to more than 2.3 cents per mile, which is more than this type of point is worth.

EXPAND

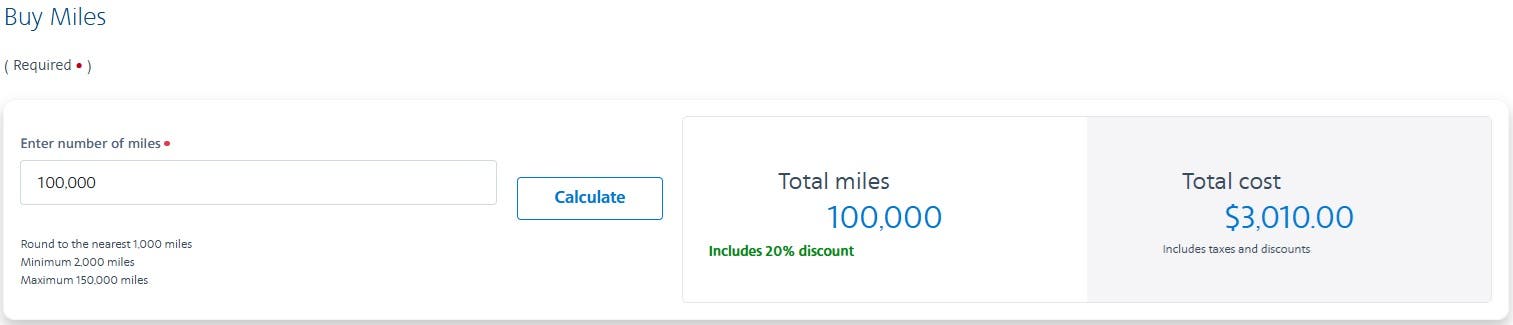

The same rule applies for buying American AAdvantage miles. This program is offering a 20 percent discount on purchased miles at the time of writing, which is nice, but they’re still asking $3,010 for 100,000 miles. This works out to a cost of just over 3 cents per mile.

EXPAND

Meanwhile, our valuations show American miles are worth an average of 1.0 cents each.

4. When you need to “reset the clock” so your award miles don’t expire

Buying miles is also a strategy you can use to “reset the clock” when your airline rewards are about to expire. This move can work well when you only have a few days or weeks to show some activity in your account before the expiration date, so you need to make something happen quickly.

However, since there are several free ways to earn more miles — including through co-branded credit card spending, airline shopping portals and frequent flyer dining clubs — you should only use this option as a last resort.

Keep in mind:

Not all airline miles expire. For example, miles earned in the Delta SkyMiles program never expire no longer how long you take to use them.

When you shouldn’t buy airline points or miles

For the most part, there are two main scenarios when you should not purchase airline points or miles:

- You don’t need them right now

- The points/miles cost more than they’re actually worth

In either case, you’re better off focusing your energy on all the free ways you can rack up airline points and miles. For example, you can look into earning a credit card sign-up bonus from one of the best airline credit cards, or you could explore some of the best flexible credit card rewards programs that let you transfer rewards to your favorite airlines and hotels. You can also look into airline shopping portals and dining clubs, which make it possible to earn points/miles for online shopping and dining out.

Which credit card should you use to buy airline points or miles?

The best credit card for buying airline points or miles will depend on the method you can use to purchase them. Ideally, you’ll pick a card that offers the most points or miles on miles purchases, along with other benefits you want.

Also note that some frequent flyer programs don’t sell points and miles directly. Instead, they use third-party sites like Points.com to facilitate the sale. This means that points and miles you purchased with a credit card may not always code as a travel purchase, so you wouldn’t have the opportunity to maximize your purchase with bonus points and miles on travel.

Generally speaking, you’ll want to buy most airline miles with a flexible travel credit card or an airline credit card. Here’s a rundown of some of the best options to consider.

Flexible travel credit cards

Flexible travel credit cards let you redeem your rewards in more than one way, and they tend to come with more general perks than airline credit cards. Consider these options for buying points and miles this year.

Airline credit cards

Airline credit cards tend to come with more frequent flyer perks, including benefits like free checked bags and priority boarding. They also offer their best rewards rates on airline purchases, which would pay off if you’re buying miles. Consider these options for some of the best programs.

The bottom line

At this point, you may have a few lingering questions. For example, is buying airline miles a good deal? Or, is it worth it to buy airline miles at all? Unfortunately, the answer to both of those questions is usually no. Buying airline miles only makes sense in a few situations, and you’ll probably still need to do some simple math before you decide. When you do run the numbers, you’ll likely find that the math isn’t in favor of buying points or miles.

Finally, remember all the ways you can earn airline rewards without paying for them, including signing up for a co-branded airline credit card (where you can earn a sign-up bonus and ongoing rewards on bonus category spending). With some research and planning, you can get all the miles you need (plus some) without paying for the privilege.

*The information about the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® has been collected independently by Bankrate. The card details have not been reviewed or approved by the card issuer.

Read the full article here