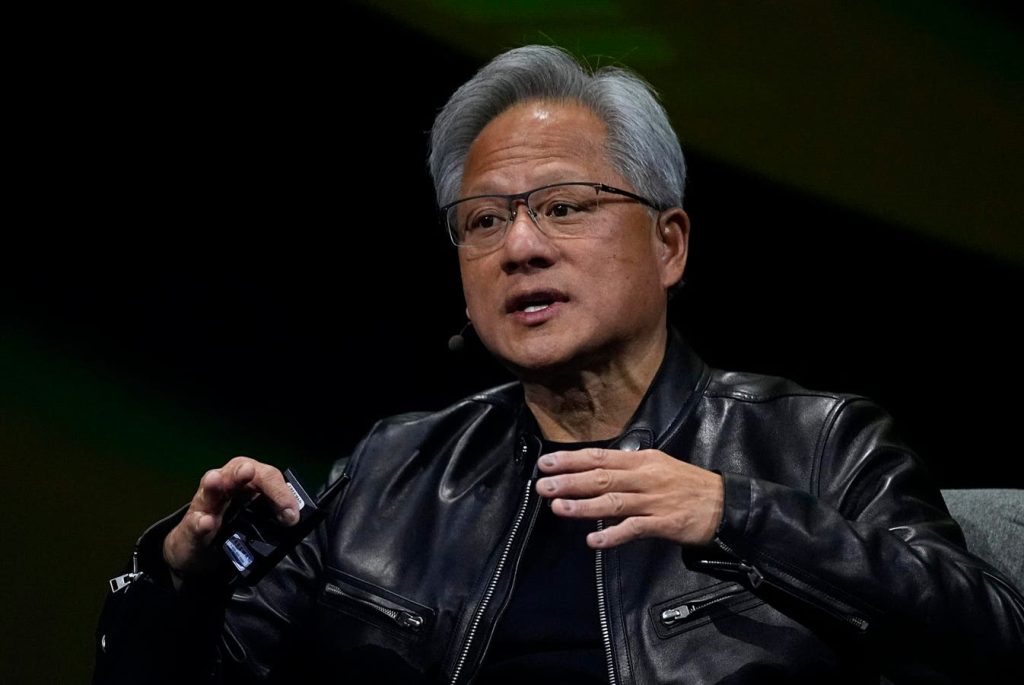

Jensen Huang, the CEO of Nvidia, discussed on the No Priors AI-focused podcast the concept of “Hyper Moore’s Law.” He suggested that AI computing performance could follow a curve even steeper than Moore’s Law, which traditionally represents a doubling of transistor count every two years. Huang stated, “I wouldn’t be surprised if the way people think about Moore’s Law, which is 2X every couple of years, we’re going to be on some kind of hyper Moore’s Law curve.”

He added to this concept by explaining the compounding effect, saying, “When you double or triple every year in just a few years it adds up. It compounds really, aggressively.”

Long the guiding concept in computing, Moore’s Law—the observation made by Intel co-founder Gordon Moore predicts that the number of transistors on a device doubles roughly every two years, hence increasing performance. For decades the semiconductor sector has been driven forward by this fundamental idea.

For investors, this vision represents a revolutionary change. A global leader in artificial intelligence and GPU technology, Nvidia is well suited to profit from such explosive development. Nvidia is solidly in the vanguard of the next development in computing as the demand for advanced AI capabilities skyrockets because the future of AI hardware and software offers hitherto unheard-of chances for growth.

What Is ‘Hyper Moore’s Law’ And Why Does It Matter?

Nvidia’s concept of “Hyper Moore’s Law” extends beyond the traditional idea of incremental increases in transistor count. Huang envisions a future where AI computing performance doubles or triples annually. Unlike Moore’s Law, which is bound by hardware advancements, this hyper-accelerated pace would be fueled by holistic improvements in software, networking, algorithms, and datacenter infrastructure. Huang points to these combined enhancements as key to unlocking larger-scale AI solutions and driving down computational costs.

This concept is critical because it suggests an exponential growth model, faster than the historical semiconductor trajectory. For investors, a “Hyper Moore’s Law” growth pace implies that Nvidia’s technologies could evolve at a rate unmatched in computing history, potentially placing Nvidia in a class of its own within the AI sector. If successful, this could spark both immediate gains for Nvidia and long-term value creation across the tech and AI ecosystems.

What’s Driving This Acceleration?

A change to a one-year product cycle, double its earlier two-year cadence, emphasizes Nvidia’s desire to dominate the next phase of artificial intelligence development. This quick turnaround represents a calculated attempt to keep ahead of rivals and match growing demand for advanced artificial intelligence capabilities. Faster cycles enable Nvidia to regularly provide high-powered, next-generation products, therefore generating an edge in a fast-evolving sector.

This acceleration uses complete advances across the AI stack—networking, software, algorithms, and hardware integration—rather than depending just on hardware. By improving every element, Nvidia is creating systems that cooperate perfectly, therefore improving total performance much beyond what chip innovation could accomplish.

Scaling tasks across bigger GPU superclusters is a key component of Nvidia’s approach since it allows computations on hitherto unheard-of levels. Comprising thousands of GPUs, these superclusters are essential for releasing fresh ideas in demanding industries.

Increased computing power and efficiency could drastically cut costs, opening opportunities for adoption in transforming industries including healthcare, banking, and logistics, thereby attracting Nvidia to long-term investors looking for exposure to AI-driven expansion.

Practical Implications And Applications Of Hyper Moore’s Law

The exponential acceleration of processing power might transform cost structures across sectors and allow a seismic change in artificial intelligence availability for smaller businesses. As the cost of computer resources declines, this democratization of artificial intelligence will enable even the tiniest companies to use machine learning for more focused consumer interaction and smarter operations. From retail to banking to healthcare, industries abound in potential gain. AI’s enhanced processing capacity could hasten medication research, improve diagnosis accuracy, and enable very individualized therapy in the healthcare sector. While retail and e-commerce use increased AI for tailored product suggestions and predictive inventory management to change the user experience, finance will witness breakthroughs in fraud detection, high-frequency algorithmic trading, and strong risk assessment.

As Huang notes, the opportunities are great since these developments open the path for breakthroughs in autonomous systems and address once impossible computing problems. For investors, Nvidia is positioned at the center of this revolution since its products are fundamental for many of these developing uses. Industry contracts and high-value alliances are likely to follow; thus, Nvidia’s alignment with this fast transformation might convert into significant rewards, hence a strategic investment issue in a future defined by AI-driven sectors.

Risks And Challenges Of Hyper-Growth In AI

Nvidia has various technical difficulties that can affect its path as it keeps stretching the limits of artificial intelligence capability. As chipmakers approach the atomic level, the physical restrictions of semiconductor materials present challenges and make further downsizing increasingly difficult. Furthermore, especially as demand for artificial intelligence processing rises, the great energy consumption and significant cooling needs of big GPU clusters create sustainability issues and raise running costs. Beyond mere technical constraints, Nvidia must negotiate difficult ethical and legal terrain. Concerns about data privacy, the ethics of AI decision-making, and possible regulatory scrutiny are rising problems Nvidia and its industry competitors have to deal with as artificial intelligence spreads over more spheres of life. The competitive environment adds more complications; businesses like AMD and Intel are stepping up their efforts to speed AI hardware developments, which puts more pressure on Nvidia to keep its technological advantage.

From an investment standpoint, exponential development carries danger as well as possibility. Although Nvidia’s innovative posture in artificial intelligence hardware fits long-term expansion patterns, the fast rate of change can potentially cause turbulence. Investors should weigh Nvidia’s strategic orientation in a transforming market as well as the near-term obstacles.

Under Jensen Huang’s visionary direction, Nvidia is positioned to lead an era of exponential expansion driven by what he refers to as “Hyper Moore’s Law,” a radical leap in artificial intelligence computer capability that might reshape the semiconductor business. Nvidia’s emphasis on expanding artificial intelligence hardware distinguishes it especially as a crucial enabler of broad-based AI adoption, a position that has the potential to bring investors significant long-term profits. Nvidia’s technology edge might translate into significant alliances and higher shareholder value as businesses from finance to healthcare incorporate AI more thoroughly. Staying current on Nvidia’s developments in AI hardware and strategic actions in the larger tech ecosystem is crucial for investors since the business significantly shapes a future, mostly depending on artificial intelligence.

Pre-Order My Book

Read the full article here