You feel awkward. You want to leave. But you can’t think of a nice way to say, “Hey, this isn’t working for me.”

No, we’re not talking about a bad date. We’re talking about sticking with a car insurance company you can’t stand! Maybe it’s the price. Maybe it’s the service. Either way, sometimes it’s clearly time to break up with your old insurer and move on to a better match.

If you’re dreading that moment, relax. We’ll teach you everything you need to know about how to switch car insurance so getting your new policy will be as easy as swiping left.

Key Takeaways

- Before you switch car insurance, you need to know the right kinds of car insurance to buy for your situation, and how much coverage you need.

- The two most common motives people have for changing car insurance are wanting a better price or getting a better customer experience.

- No matter how frustrated you might be with your current policy, never cancel it until you have the new policy in place—even a few days without coverage could wreck your car and your finances.

- Sometimes major life changes send your premiums up—which is the perfect time to look for a better rate.

How to Switch Car Insurance

Whether your insurance company is overcharging you or the customer service sucks, switching car insurance can be a smart move—and we’re here to help! Let’s look at seven simple steps to get it done.

1. Decide How Much Car Insurance Coverage You Need (and What Kind)

A lot of people don’t know how to change car insurance because they don’t actually know what (or how much) coverage they need to buy. So before you just swap one skimpy policy for another, let’s cover the basics of what you need here:

- At least $500,000 in liability insurance (we’ve heard too many stories from people who know firsthand that the state minimum liability isn’t enough)

- Comprehensive insurance with a policy limit equal to the value of your car (it’ll pay to repair or replace your car if it gets ruined by bad luck, like if a tree falls on it or there’s a hailstorm)

- Collision insurance if you still owe money on your car and/or haven’t saved 3–6 months’ worth of expenses in a fully funded emergency fund (if you’ve checked both of those boxes, you can probably skip this coverage because you’ve got enough cash on hand to repair your car if it gets damaged in an accident)

2. Compare Car Insurance Policies

Here’s where you can really tell who’s a financial nerd and who’s a free spirit. Nerds love this part. Comparison shopping is your thing. This is where you shine. So the thought of getting quotes from five, six or even 10 insurance companies doesn’t bother you. You just want to know that you’re getting the best deal, whatever it takes.

For free spirits, this sounds like zero fun. If that’s you, you probably just remembered that you have to go do that thing, and you better leave right now or you’re going to be late . . . whew, that was close! You almost had to shop for car insurance. Ew.

Nerds, listen up—the free spirits are right! Shopping around for car insurance is a lot of work. And if you’re being totally honest, it’s not the best use of your time. But free spirits, the nerds are right too. It’s important to get the best deal on car insurance. (Hello, that’s why you wanted to switch in the first place!)

Don’t let car insurance costs get you down! Download our checklist for easy ways to save.

That’s why we recommend working with a RamseyTrusted insurance pro. These independent insurance agents are experts on how to switch car insurance. They’ll do the hard work for you, so you can get the best rates and save hours of time you would’ve spent getting your own quotes.

3. Negotiate With Your Old Auto Insurer (If You Want)

We love a good bargain—and getting one starts with asking for one. If your research helped you snag a low quote and your only complaint about your current insurer is the price, tell them what the other guys are offering. If there are any discounts available on your policy for things like installing a safety tracking device or taking a safe-driving course, they may be willing to match or even beat the other offer. (Of course, if you hate your insurance company and are just over it, it’s totally okay to skip this step and go to the next one.)

4. Consider Waiting to Avoid Cancellation Fees

Sometimes when you go to cut the cord, you find out there are strings attached. In the case of changing your car insurance, there could be cancellation fees. Ugh!

We know, it’s awful for the insurance company to make one last grab at your wallet as you go. But sometimes, that’s just the way it is. If they’re going to charge you an arm and a leg to cancel your policy, it may not be worth switching right this second.

Instead, you have an extra step in between researching and buying: waiting until it’s almost time for your policy to expire. As that day approaches, buy a policy with the new company and let the old policy expire on its own.

5. Buy Your New Policy

You’re through with researching, comparing and negotiating (and maybe even a short waiting game). Congrats on finding the right policy at the right price. But at the risk of saying something super obvious, don’t skip the most important step, which is actually switching over your car insurance!

Once you’re ready to buy, lock that new premium in. And by the way—you still have a step (or two) to go before you’ve made your switch complete.

If you pay for several months at a time, you can actually get a discount and save some money. That’s what we call a #budgetingwin.

6. Cancel Your Old Policy

Can we be real with you here for a second? (That’s a silly question—of course we can!) Look, it’s really, really stupid to drive around without insurance. Even if it’s “just for a few days.” Because it doesn’t take a few days to wreck your car, damage someone else’s property or—worse—hurt yourself or someone else in an accident. It takes a few seconds, tops. Not to mention, in many states the Department of Motor Vehicles keeps tabs on whether drivers are insured, and could fine you for a coverage gap—or even take your license!

And driving without insurance is practically begging for Murphy to show up. You know Murphy—he’s the “anything that can go wrong, will go wrong” guy. He’d love nothing more than to total your car and cost you thousands.

So before you cancel your old insurance policy, make sure your new one has taken effect. Then be sure you’ve printed your new vehicle ID cards and put them in the glovebox in case you need them!

Once you have a copy of the new policy and your vehicle ID cards are actually in your vehicle, you can cancel your old policy. (Woo-hoo!) But before you celebrate too hard, make sure the old policy is actually canceled. Some insurance companies let you do this over the phone. If that’s the case, ask for written proof too. That way if they accidentally try to bill you later, you can show them that your policy really was canceled.

Other insurance companies require you to submit a written cancellation letter. So check their rules and follow them to the letter (pun intended). Then your old insurance will be canceled, and you’ll be ready to ride off into the sunset with your new insurance policy in hand.

7. Notify Your Car Loan Provider or Leasing Company

Let’s keep it real—we know most cars out on the road today are financed. Car payments are a sad fact of life for millions! Hopefully that’s not your situation, but if you have a car loan or lease, most lenders require you to carry both collision and comprehensive coverage. Letting your lender know about your new policy is the final step in switching car insurance.

And if you do have a car loan, don’t worry! You can become debt-free and build wealth by following the Ramsey Baby Steps. And having the right insurance in place is essential protection for you and your family along the way.

Tip: If you’re looking to save money on car insurance, think about your deductible too. That’s how much money you pay before the insurance company starts chipping in. A high deductible means you pay more up front for repairs if something happens to your car, but you’ll pay lower monthly premiums. Unless you’re super accident-prone, it’s worth having a high deductible to save a little cash every month.

Reasons to Switch Car Insurance Companies

Now that you know how to switch car insurance, let’s talk a little bit about the why.

There are two main reasons most people want to switch car insurance: Either their premiums are too high or they’re not happy with the company itself.

(If it’s the second one, here’s a hint: It’s always the right time to stop working with a crummy company!)

But let’s go back to that other reason—price. Car insurance can be expensive. Of course you’ll notice if your premium jumps up all at once, and that’s definitely a great time to shop for new insurance. But premiums can also creep up slowly over time. There’s nothing worse than a creepy premium, so it’s good to shop around for better rates once a year.

Look at your current coverage. We mean really look at it—not just the part that tells you how much to pay every month. Double-checking your current policy now will help you know what to look for when you start shopping for a new one. After all, it’s kind of hard to shop for something when you don’t even know what you need.

So ask yourself some questions. Are you just carrying the minimum liability insurance? (You need more.) Did you buy collision, but not comprehensive? (You might need both.) Figure out if you have any gaps in coverage or other things you want to change, and make a shopping list.

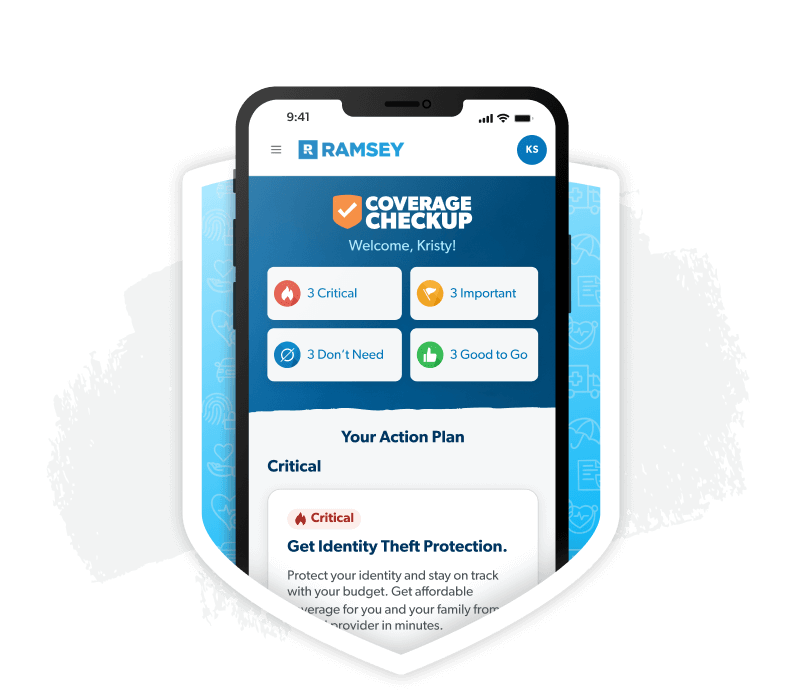

Are You Protected With the Right Insurance?

Take the Coverage Checkup to get a personalized action plan that breaks down what to keep, add or nix so you can take control of your insurance with confidence.

Take the Coverage Checkup

When to Switch Car Insurance Companies

Here’s something you may not have thought about. Sometimes, major life events affect your premiums—and the company that was giving you the best deal before isn’t anymore. It’s a good idea to consider switching car insurance if you’ve:

Now you’ve got the lowdown on how to switch car insurance, including the main times and reasons to go shopping. But maybe you’re still wondering about the smartest way to put your new learning into practice! If so, we have some practical next steps you can take toward switching car insurance today.

- If you want to learn a little more about car insurance and how it works, read our article about the seven main types of car insurance.

- Gather all the information you’ll need to apply for a new policy.

- Track down the VIN numbers for your vehicles.

- Work with a RamseyTrusted insurance agent who can look at your unique situation and find you the best protection at the right price.

Read the full article here