Whether you have to report an inheritance on your taxes depends on what you inherit and the subsequent handling of that inheritance. While inheritances themselves are often not subject to federal income tax, certain inherited assets can generate taxable income once they begin producing interest, dividends or distributions. Because inheritance…

Images by GettyImages; Illustration by Jessa Lizama/Bankrate Key takeaways Lower credit scores signal higher risk of default to lenders, so lenders will limit loan amounts. Borrowers with bad credit get approved for unsecured loans with an average amount under $2,000, according to TransUnion data. Adding a cosigner or co-borrower with…

A tax refund often feels like a sudden financial windfall, offering a brief moment of relief. However, instead of treating it as a ticket for a shopping spree, consider using it as the ultimate opportunity for some financial spring cleaning. By strategically channeling your refund, you can effectively pay down…

Moyo Studio/GettyImages; Illustration by Hunter Newton/Bankrate Key takeaways Most personal loan lenders require documents to prove your identity, income, bank account and address. Lenders collect information about your credit score, loan purpose and monthly expenses to determine your eligibility and loan terms. Gathering all necessary documents and information before applying…

Spotlight This Week

More ArticlesPersonal Finance

Last year, on the day before Tax Day, my mom was scheduled to fly into Philadelphia International Airport to stay…

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

With Republicans ending the Grad Plus program, private lenders are eyeing billions in new business, while some students could be…

Featured Articles

Key takeaways A personal loan is money you can borrow in a lump sum with a fixed payment to finance large purchases, consolidate debt or cover emergency expenses. Interest rates, monthly payments and repayment terms vary based on creditworthiness, income and other factors. You’ll get…

Dept Managmnt

Does a Consumer Proposal Affect My Credit Score? Yes, filing a consumer proposal will affect your credit score. Your score reflects your past…

Banking

These entrepreneurs, traders and investors are making an outsized impact in fintech, crypto and traditional financial services.By Jeff Kauflin, Hank Tucker and Nina…

Credit Cards

All News

Key takeaways Investing in an S&P 500 index fund is an easy way to get instant exposure to hundreds of the largest companies in the U.S. in one investment vehicle. All S&P 500 funds are fundamentally invested in the same stocks, so choosing the “cheapest” one (the one with the…

Whether you can claim an adult child as a dependent on your taxes depends on their age, income and living situation, as well as the level of financial support you provide to them. The IRS allows parents to claim certain adult children if they meet the criteria for either a…

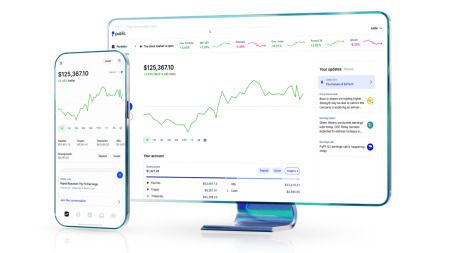

Public is an investing platform that offers a solid trading experience, free trades on stocks and ETFs, easy access to bonds — and options traders will enjoy getting money back on their trades through Public’s rebate program. Other key features include: Fractional shares, so you can trade with as little…

A nursing home cannot directly seize funds held in an individual retirement account (IRA). However, retirement accounts in many states are generally treated as countable assets for Medicaid eligibility, which means their value can affect whether you qualify for Medicaid coverage of long-term care. In many cases, this requires a…

Capital gains are the profit you earn when you sell an asset like a home, business or stocks. Those gains are subject to capital-gains taxes, but capital gains are taxed differently depending on the type of asset — and how long you owned the asset. That’s because, while the federal…

Key takeaways The first step to saving is setting specific, achievable goals and tracking your progress using a digital budgeting tool, spreadsheet or pen and paper. Following a budget can help you identify ways you can add to savings as well as pay down debt. Ways to help you save…

“I’m standing there watching my house burn, and I’m like, oh my goodness, this is everything that I worked for.” When Rahkim Sabree, AFC followed a gut feeling to return home early from an outing in October, he didn’t expect to find his living room engulfed in flames. “It’s when…

Key takeaways Using extra cash to pay off your mortgage loan early can save homeowners a hefty amount of interest over time. However, putting available funds into investments instead might yield a more significant return and make you more money. The answer to which is right for you will depend…

Delmaine Donson/Getty Images Debt relief companies work on your behalf to negotiate your debts, usually through a settlement for less than you owe. While this can be a useful tool for some types of debt, not all debt can be handled through debt relief. In addition to the type of…

staticnak1983/Getty Images Key takeaways Short-term CDs typically are those that mature within one year, while long-term CDs have terms ranging from three to five years. Currently, some top-earning long-term CDs have slightly higher interest rates than short-term ones. You can use a CD ladder to take advantage of the benefits…

Editor's Pick